CALCULATING YOUR NET WORTH

May 18, 2015

Follow Networthy on TwitterIn my very first post here on Networthy, I talked about how I’ve measured my net worth for the last three years and used that number as a benchmark to measure my financial health. (Hence the blog name!) But I didn’t really get into what net worth is, exactly, or why I measure my success that way rather that by the amount of debt I’ve paid off or the amount of money in my savings accounts. So let’s go over that in a little detail here.

In absolutely the simplest terms, your net worth is the value of all of your assets, minus any debts you owe.

It really is that simple, as an equation. The tough part is figuring out what each of those two numbers (assets, debts) are.

First of all, you need to know where all of your money is, and where all of your debts are. This is honestly the most important first step in any kind of financial plan. If you don’t know exactly what you owe, where you owe it, what your payments are, how much cash you have to make those payments or what you could sell to get cash, then how can you plan to improve your situation?

I like to use Mint.com to organize all of my accounts in one place. I also use CreditKarma.com to check and make sure that I always know what my credit report says and that I know every debt that is under my name. (Posts on these great services coming soon!)

Now let’s break it down. I’ve organized these tables according to how accessible the asset is, and then by how urgent the debt is.

Assets:

Liquid Cash — Any dollars that you have living in checking, savings or under the mattress.

Liquid Investments — Any money you have invested in the stock or bond market which you can withdraw at any time.

Non-Liquid Cash — I’m particularly thinking of Savings Bonds, but you could also include money that is locked into a bank account like a Certificate of Deposit for the next few years.

Retirement Accounts — Investments which you cannot withdraw (at least not without penalties) until you are in your 60s.

Vehicles — Specifically cars, but also any boats, ATVs, snowmobiles, bikes, etc that have some resale value.

Valuables — Items in your home which have value due to being collectible or rare. Artwork, jewelry, antiques, etc. I’d recommend that you ignore this category unless you can think of specific items which have a high value and which you’d be willing to part with.

Real Estate — Your home, if you own it, along with any other properties you own such as a vacation home or investment property.

We could add more here, for example, if you own your own business, but this is plenty for your average person.

Debts:

Credit Card Debt — You know this guy. Any money you owe on a revolving credit account.

Personal or Unsecured Loans — Loans which you took out for a wedding, medical expense or other large purchase.

Auto or Other Vehicle Loans — An installment loan which you have taken out on a vehicle or other asset which is depreciating in value. (Cars are not an investment!)

Student Loans — Self-explanatory. If you’re struggling with student loans, make sure to check out the resources at the bottom of this post.

Mortgage — A loan which you took out against the value of your real estate.

Any other debts you owe, like to Vinny the Loan Shark down the street, should also be included here.

Now add it all up, and find out your net worth! I hope it wasn’t too painful. But if it was, just know that I’ve been there, and things can get a lot better.

The reason I use net worth to measure success is that it gives me the whole picture of my finances. For example, let’s say that I start out with no money. I decide that I need to have a $10,000 emergency fund. I’m going to measure success solely by the amount of money in that savings account. I funnel every spare dime to that account for months and months, living on a shoestring budget. But, well, I promised I’d go out with the girls on Fridays and get a few drinks. So I put it on a credit card. And I need to get a graduation present for my cousin. It’s fine, I’ll charge it. And shoot, the electric bill is higher this month than I expected! Guess I’ll put it on my credit card. And I really want to keep saving, so I’ll just make minimum payments on it every month. It’s no big deal, because I see that number in my savings account going up! I’m on a path to success, right?

A year or two later, you look up and say, hooray! I have $10,000 in a savings account earning 0.7% interest! ...And $10,000 on a credit card being charged at 17% interest… womp womp.

You hit your goal, only to look up and realize that you’re actually in worse financial shape than you were when you started at zero.

And don't even get me started on why net worth is a better indicator of financial health than your salary number! How many stories have we heard about celebrities and athletes who manage to go bankrupt on seven-figure salaries? Do not envy The Joneses with their 100,000 salaries. If they've wrapped themselves up in a million debts, their net worth may be lower than yours!

That’s why net worth is so important. It forces you to balance your income against your spending, and your savings goals against your debt payoff. It gives you perspective on the actual helpfulness of your financial choices.

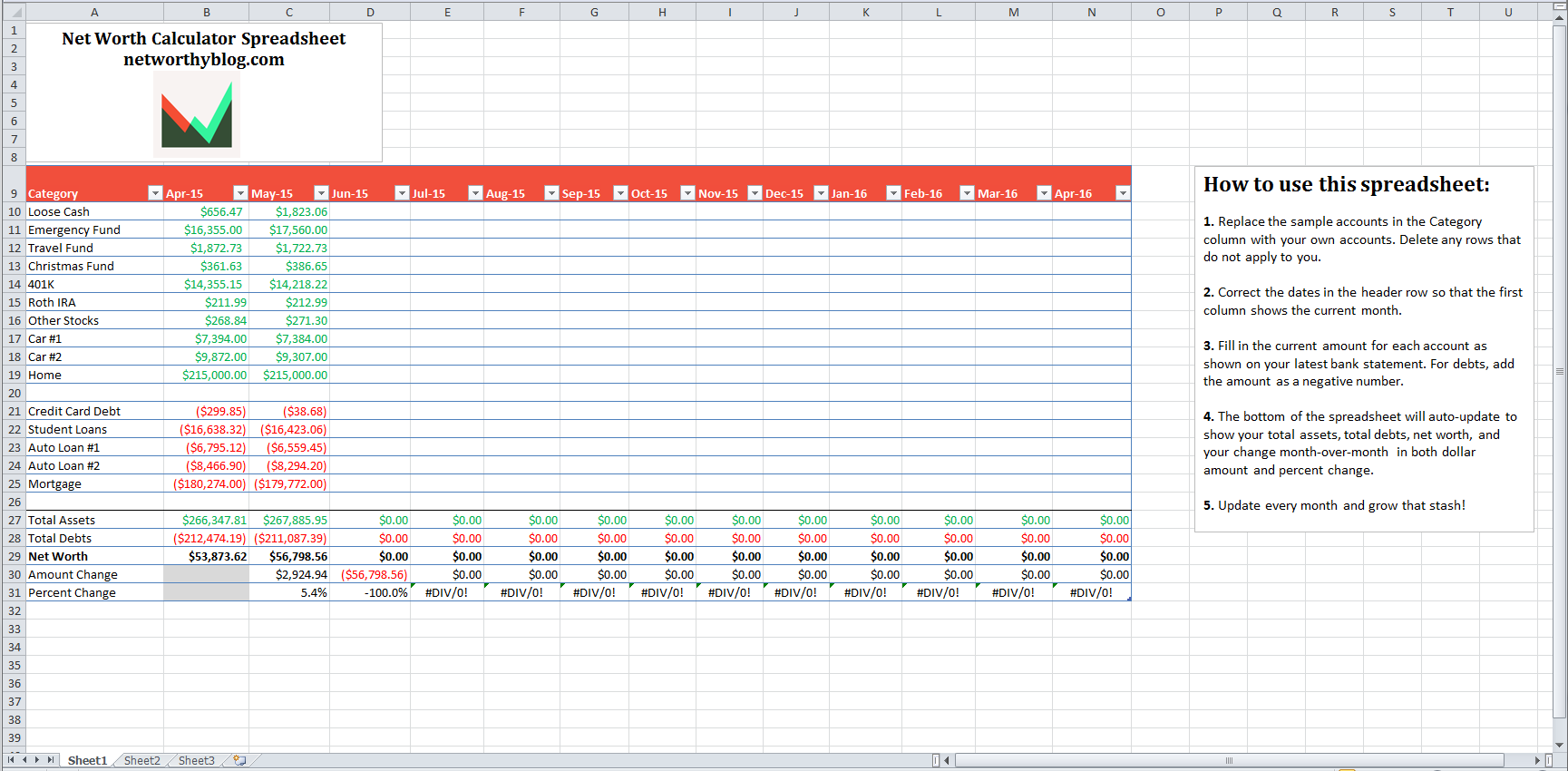

Mint.com, mentioned above, does a great job of auto-tracking your net worth for you and I highly recommend that you go ahead and use them. But if you like to get really granular, prefer the DIY approach or if you have accounts that can’t hook up to Mint, I’ve put together a handy-dandy spreadsheet to get you started!

Click here to download the spreadsheet.

I hope it’s helpful. Let me know in the comments or email me if you’d like to see changes to the spreadsheet!