LOW SPOONS FINANCE

December 2, 2015

Follow Networthy on TwitterHey world. It’s been a few weeks since my last post, because good lord have I been low on spoons lately.

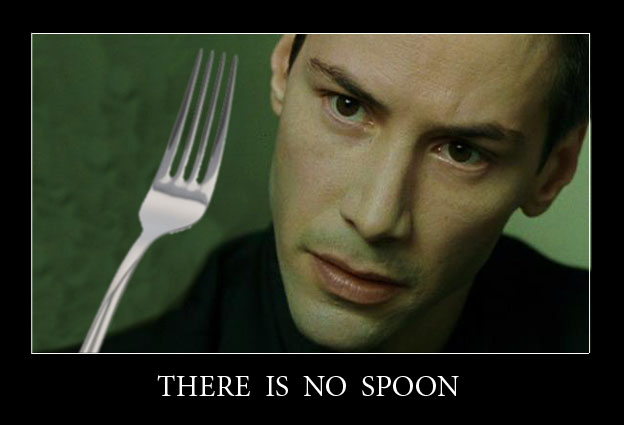

No, not those kind of spoons.

I’m talking about spoon theory.

If you’re unfamiliar with the term, I highly recommend you check out the original spoon theory post, but in a nutshell it means this: every person on earth wakes up each morning with a certain amount of energy or stamina. Picture that energy as a handful of spoons. If you’re healthy physically and mentally, you get a nice big handful -- maybe even an infinite supply. If you have chronic pain, a degenerative syndrome, or mental illness, you wake up every single day with low spoons. Every task you do in a day -- and this includes emotional labor -- takes a spoon. Getting dressed costs a spoon. Packing lunch? A spoon. Driving to work? A spoon. Working through the day? Lots and lots of spoons. Calling your friend who’s going through a break up to comfort them? A spoon. Remembering that you forgot to pick up something you need for dinner tonight and don’t have time to get it? The stress costs you a spoon. When you run out of spoons, that’s it. Your day is over. You need to go to bed. It doesn’t matter if the house is a mess, you haven’t eaten dinner, and you have emails to answer. You’re done.

So when you wake up with low spoons, you have to budget your energy. You can’t take care of yourself, and do a good job at work, and keep your house clean, and do your side hustle, and plan the holidays. You have to pick.

And I actually made a classic mistake for a spoonie. I spent the past few weeks stealing from my future spoons. My husband and I just took a big trip together and we knew it would be expensive, so I spent a month working three jobs, taking paid surveys, hyper budgeting and couponing, and neglecting health boosters like my usual monthly massage which help me deal with my chronic pain issues. We had an amazing trip and I was really proud that we could afford it. But now I’m paying for it with spoons. I’m in spoon debt! I’m still paying myself back for the extra energy I spent, meaning I’m waking up every day with even fewer spoons than usual.

Hence, no blog posts for a while.

But this did get me thinking about what it means to try to manage your money when you’re low on spoons. Because, let’s be real, a lot of financial advice asks you to spend a lot of spoons to avoid spending a few dollars. Biking to work every day? Making all your own food and packing lunch for work? Working multiple jobs? These things take a ton of spoons. But they really are great ways to secure a better financial future for yourself -- something that can be doubly important if you expect to need a lot of healthcare over the years.

So here’s how I try to stay on track on my finances when my spoons are low.

Batch Cooking

If I spend one weekend day cooking, I can eat leftovers all week and not have to think about it. Although it takes a few spoons to do the first day of cooking, it works out to fewer spoons overall. it can also be good to protect your cooking day from spoon stealers like family events and errand runs. Just decide that on Sundays (or whatever day) you are going to stay home, sleep in, focus on batch cooking and freezing, and then go back to bed.

Grab and Go Food

But honestly, cooking anything at all can be too much. I know that. And if you have depression or chronic pain, these things don’t always work on your schedule. If your batch cooking day ends up being a day that you can’t even make it out of bed, you need a plan B.

When your spoons are low, it can be so, so tempting to eat at restaurants. You don’t have the energy to cook, and you’re never going to get your spoon count up if you skip meals. So let go of your shame, and go find some pre-made meals to get you through. Stock up on Lean Cuisine, top ramen, boxed mac and cheese, Trader Joes burritos,and my personal favorite:

These meals may be dripping in sodium and preservatives, but fuck it. They cost like $2.50 and they barely take a spoon to make. If your only low-energy alternative is takeout, this is a way way cheaper option.

Also, yogurt is my personal savior. It’s insanely cheap, good for you, and because yogurt is trendy right now you can get it in every possible flavor. Throw a cup of yogurt in your bag in the morning and breakfast is all set.

Mixed nuts or almonds can also be a good go-to -- and you can keep stashes at work for moments that you just can’t stand the thought of getting up and buying a snack.

Automate Your Bills and Savings

If you have a high spoons day, or a friend or partner to delegate this to, spend a few hours and set up all your bills to autopay, and your credit cards to pay off their balance each month. Then you only have to worry about making enough money to cover the bills, not whether you paid them at all. And automate savings transfers to happen each month too.

Find a Way to Make Comfortable Transportation Cheaper

We can promise ourselves that we’ll walk to work, or that we’ll bike, but if your spoons are low, you need to save them for other tasks. And if you’re telling yourself that you’ll walk, then waking up every day with no spoons and calling an Uber, that’s not the best use of your funds. For me, budget friendly transportation means driving a small, cheap car that gets good MPG. For you, it might mean springing for an annual bus pass or subway pass. Also, several credit cards have set up deals with Uber that give you a small amount of cash back for each ride, which is at least a better alternative than nothing.

Opt for High-Return Self Care

There are some things worth investing in as a low spooner: a good mattress and firm pillows. Warm clothing that doesn’t require ironing or dry cleaning (what a waste a spoons!). Doctor’s visits, and ongoing care like massage, therapy, etc. Budget for these things and be smart: shop clothing sales and buy realistic, high quality pieces, put money in a health savings account so you can pay for health care with pre-tax money, and see if your care providers can offer long term care discounts. Make sure your doctor is prescribing you generic versions of your medications. And avoid the urge to throw your money at quick fixes. Some items like manicures or meals out might come across as ways to reward yourself for making it through a low spoon day, but if you end up worrying about the money you spent, that will just steal spoons from future you. Think long term: what’s going to help you get to a future in which you wake up in the morning with a few more spoons?

Reach Out to Your Friends

Most importantly of all, you need to make sure that you aren’t isolated by your need to recharge your energy. If you want to be social but need to keep the activity low spoons, let your friends know. Tell them you miss them but that you’re only up for something like board games or watching a movie together. Let them know that you can’t cook tonight, but that you’ve got some killer frozen pizza you can warm up. And maybe the house won’t be spotless and maybe you’ll be in sweatpants. So what? Let them know what you’re capable of and what you need, and good friends will just be glad to spend time with you and be a non-draining presence in your life.

Good luck to you, my fellow spoonies! May your doctors be smart, your meds balanced, and your net worth ever-growing.